Chase Marriott Bonvoy Boundless Credit Card [Updated 2026.1: 5FN Sign-up Bonus Returns!]

The latest sign-up bonus is 5 FN (up to 50k), which is the highest sign-up bonus for this card. By the way, there's also a $100 Airline Credit bonus in 2026

![Chase Marriott Bonvoy Boundless Credit Card [Updated 2026.1: 5FN Sign-up Bonus Returns!]](https://ebaydiy.com/uploads/images/202601/img_w860_696108099c1373-22937350.jpg)

Chase Marriott Bonvoy Boundless Credit Card (formerly known as Chase Marriott Rewards Premier Plus Credit Card) - Marriott Hotels (nicknamed "Mario") Credit Card Introduction

[Updated 2026.1] The latest sign-up bonus is 5 FN (up to 50k), which is the highest sign-up bonus for this card. By the way, there's also a $100 Airline Credit bonus in 2026: Earn $50 statement credit when booking flights of $250 or more directly with an airline, once in the first half of the year and once in the second half. New applicants after version 1.8 are automatically enrolled in this benefit, and existing customers can also enroll through this link .

Application link

feature

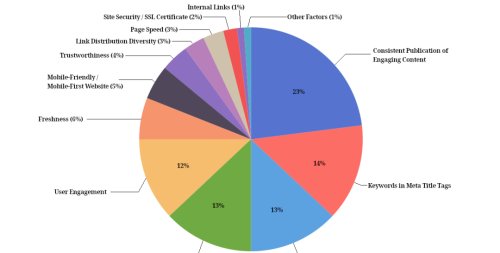

- 5. Free Night (FN) Sign-up Bonus: Spend $3,000 within the first 3 months to earn 5 Marriott Free Nights (FN) and up to 50,000 points. This is one of the best sign-up bonuses for this card.

- The points earned on this card are Marriott Points, which we value at 0.7 cents per point. A 50k sign-up bonus is valued at approximately $210. Therefore, the maximum sign-up bonus with 5 sign-up bonuses is worth approximately $1,050.

- Earn 6x Marriott Points on purchases at Marriott hotels and 2x on other purchases.

- [New] Earn 3x points on your first $6,000 spent annually at grocery stores, gas stations, and dining.

- Starting from the second year, after paying the annual fee each year, you will receive one free night, which can be used at Marriott hotels with 35k points or less.

- Get Marriott Silver membership with cardholder . Spend $35,000 annually to get Marriott Gold membership . Friendly reminder: The most important benefits (complimentary breakfast, lounge access, room upgrades, etc.) require Marriott Platinum membership or higher.

- Each calendar year, you receive 15 elite night credits (Note: elite nights are used to calculate membership tiers and are generally called qualifying nights, not free nights). Each Marriott account can receive a maximum of one qualifying night from a personal co-branded credit card, even if you hold multiple cards. If you have a Marriott Business card, you can receive an additional 15 nights.

- [New] Earn 1 elite night credit for every $5,000 spent (Note that elite nights are used to calculate membership levels and are generally called tier nights, not free nights).

- No Foreign Transaction Fee (FTF)。

shortcoming

- The annual fee is $95, and the first year's fee is not waived.

- It should be noted that Free Nights cannot be accumulated and are only valid for one year.

Marriott Points Introduction

- Marriott Points are the most flexible type of points (inheriting a large number of airline partners after Marriott merged with SPG).

- Credit cards that allow you to earn Marriott points include: Chase Marriott Bonvoy Boundless , Chase Marriott Bonvoy Bold , AmEx Marriott Bonvoy Brilliant , AmEx Marriott Bonvoy Business , and cards that are no longer available for application but can still be obtained through card transfer: Chase Ritz-Carlton and AmEx Marriott Bonvoy .

- Marriott Points are stored in your Marriott account, not on your card, so completing levels will not result in the loss of points.

- Marriott Points will expire if there are no inflows or outflows in your Marriott account within 24 months. Earning or redeeming points through spending, hotel stays, or other activities during this period will extend the expiration date.

- Marriott points can be converted into a significant number of airline miles (no Marriott credit card required), with a conversion rate of 3:1.25 (i.e., a 3:1 conversion, plus an additional 5,000 miles for every 60,000 Marriott points converted). Recommended airlines include: Alaska Airlines (AS) (non-alliance), Japan Airlines (JL) (Oneworld), United Airlines (UA) (Star Alliance), American Airlines (AA) (Oneworld), All Nippon Airways (ANA, NH) (Star Alliance), Korean Air (KE) (SkyTeam), etc. Using these airlines in this way, Marriott points are worth approximately 0.7 cents per point.

- Marriott points can also be redeemed at its own hotels (including hotels under the Marriott, Ritz-Carlton, and SPG brands). See the Marriott redemption table for the points required for hotel redemptions . Generally, redeeming hotels in the lowest category is the most cost-effective (more common in China, less so in the US). Using points this way, the Marriott points are worth approximately 0.7 cents per point.

- In summary, our overall valuation of Marriott is approximately 0.7 cents/point.

Recommended application time

- [5/24 Policy] If you have five or more new credit card accounts within two years (all new accounts, not just Chase accounts), Chase will not approve the card for you, regardless of your credit score. For details on how to circumvent the 5/24 rule, please see "Chase 5/24 Rule Explained" .

- You will not receive the sign-up bonus and your application will be instantly rejected if you meet any of the following conditions: (1) You currently hold a Chase Marriott Old Card , Chase Marriott Bonvoy Bold , or this credit card; (2) You have received a sign-up bonus for a Chase Marriott Old Card , Chase Marriott Bonvoy Bold , or this credit card within the past 24 months . Note that the sign-up bonus period starts from the moment you receive the bonus, not from the moment you open or close the card.

- [New] You will not receive the sign-up bonus if you meet any of the following conditions:

- Currently held, or previously held within the last 30 days: AmEx Marriott Bonvoy (formerly AmEx SPG) ;

- Applications submitted and approved within the last 90 days include: AmEx Marriott Bonvoy Business (formerly AmEx SPG Business) , AmEx Marriott Bonvoy Bevy , and AmEx Marriott Bonvoy Brilliant (formerly AmEx SPG Luxury) .

- You must have received a sign-up bonus or upgrade bonus within the past 24 months: AmEx Marriott Bonvoy Business (formerly AmEx SPG Business) , AmEx Marriott Bonvoy Bevy , AmEx Marriott Bonvoy Brilliant (formerly AmEx SPG Luxury) .

For details on the restrictions between Marriott Bonvoy co-branded cards, please refer to " Summary of Marriott Bonvoy Co-branded Card Sign-up Bonus Restrictions and Application Strategies ".

- Try not to apply for more than two Chase cards within 30 days, otherwise you will likely be rejected.

- It is recommended to apply after having a credit history of more than one year.

Summarize

The sign-up bonus for this card is pretty good. Whether it's worth the annual fee depends mainly on whether the 35k points limit for Free Numbers (FNs) can cover the cost. 35k FNs plus points can be redeemed for up to 50k hotel nights. Although Marriott hotel redemption is currently dynamic, it's still relatively easy to achieve a $95 value after redeeming 35k FNs.

| Chase Marriott Bonvoy Bold | Chase Marriott Bonvoy Boundless | Chase Marriott Bonvoy Bountiful | Chase Ritz-Carlton | AmEx Marriott Bonvoy | AmEx Marriott Bonvoy Business | AmEx Marriott Bonvoy Bevy | AmEx Marriott Bonvoy Brilliant | |

|---|---|---|---|---|---|---|---|---|

| Annual Fee | $0 | $95 | $250 | $450 | $95 | $125 | $250 | $650 |

| Various Credit | none | none | none | $300 airline incidental credit | none | none | none | $25*12 dining credit |

| Free Night | none | up to 35k | none | up to 85k | up to 35k | up to 35k | none | up to 85k |

| Marriott Membership | Silver | Silver | Gold | Gold | Silver | Gold | Gold | Platinum |

| Elite Nights | 15N | 15N | 15N | 15N | 15N | 15N (extra) | 15N | 25N |

After applying

- To check your Chase application status, you can call 800-436-7927. This is an automated call, and the information you receive will likely be as follows: Receive decision in 2 weeks: The chances of approval are relatively high; Receive decision in 7-10 days: The chances of rejection are relatively high; Receive decision in 30 days: This simply indicates that further review is needed, and there is no further information available at this time.

- Chase reconsideration backdoor phone numbers: 888-270-2127 or 888-609-7805. If your Chase card application isn't approved instantly, you can prepare to call these numbers. Customer service will directly ask for your personal information and then proceed with the review; they rarely ask questions, just listen to the music… After the music plays, customer service will give you a decision, often just an approval or rejection. They may also ask for supplementary materials; just listen carefully to the requirements and bring the corresponding documents to a branch or fax them online.

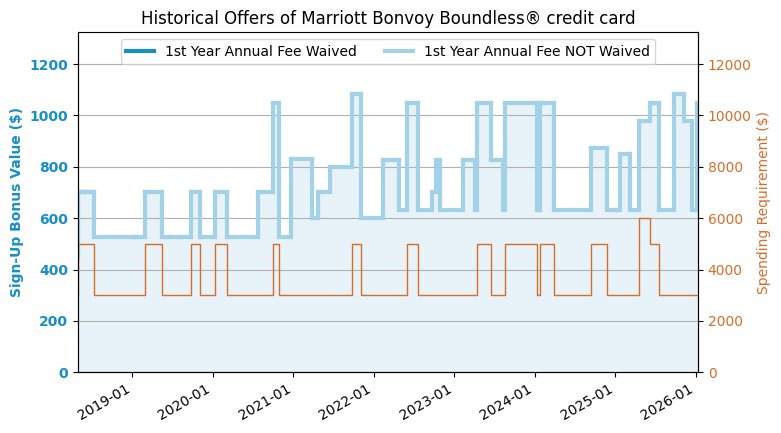

Sign-up Rewards Trend Chart

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

![Citi Strata Elite Credit Card [Updated October 2025: 100k Sign-up Bonus]](https://ebaydiy.com/uploads/images/202601/img_w860_69610b6ca69033-41950220.jpg)

![Citi Strata Elite Credit Card [Updated October 2025: 100k Sign-up Bonus]](https://ebaydiy.com/uploads/images/202601/img_w500_69610b6ca9be86-12427828.jpg)